Digital competition in the U.S. restaurants and delivery space is heating up fast. In Q3 2025, these brands invested about 1.85 billion dollars in digital advertising, with just a handful of players shaping a large share of the conversation.

Domino’s, Starbucks, McDonald’s, and Taco Bell together accounted for roughly one quarter of all category spend. Their strategies show how market leaders are reallocating budgets, leaning into video, and using large screens and social feeds to keep their brands top of mind as holiday season planning begins.

Category Spend and Channel Shifts

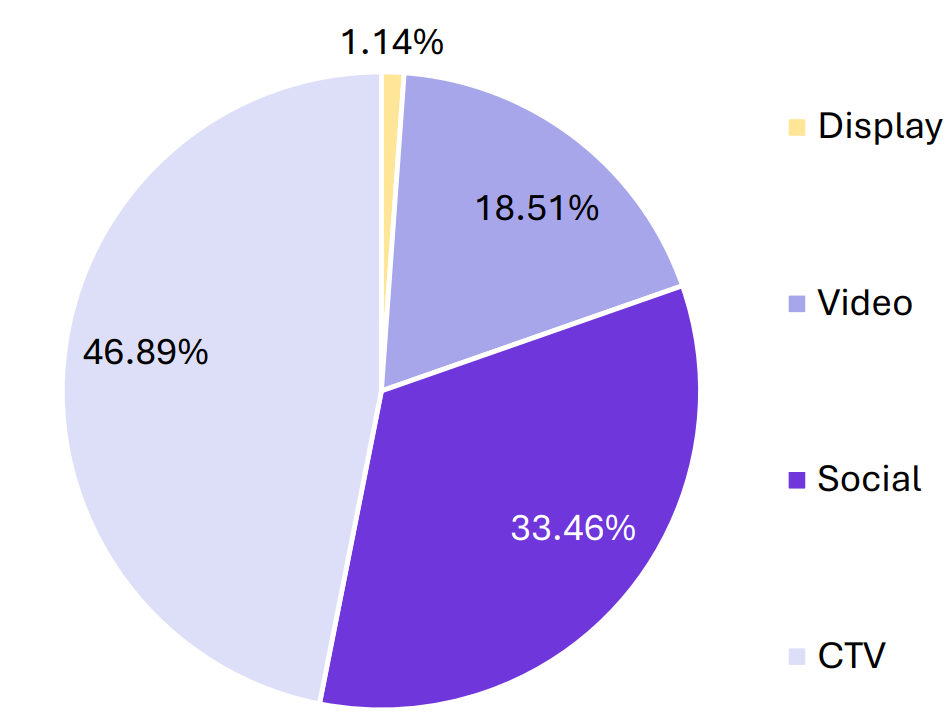

Connected TV did the heavy lifting in Q3. It grew about 13 percent year over year and captured almost 47 percent of total digital spend, as advertisers shifted away from standard display and legacy online video. CTV’s premium environment and household reach are turning it into a core channel rather than an experimental line item.

Social media, meanwhile, contributed close to one third of spend but delivered more than half of all impressions. Even with a modest 5 percent decline in spend, social remained the most efficient reach driver, especially for campaign bursts built around offers, new products, and time-sensitive promotions.

Where Advertisers Are Winning Attention

Domino’s was the clear category leader, investing about 249 million dollars, or 13.4 percent of total digital spend. A video first mix, with roughly 57 percent of the budget in online video and 35 percent in CTV, generated an estimated 19 billion impressions, far more than any competitor.

Starbucks leaned into a social first strategy, dedicating nearly 45 percent of spend to social and generating the majority of its 7.9 billion impressions there. McDonald’s focused on premium placements, with CTV CPMs above 29 dollars, trading pure volume for high impact visibility. Taco Bell maintained a balanced presence, with more than half of spend in CTV and about 30 percent in social to sustain steady reach.

Regional Battlegrounds and Creative Lessons

Los Angeles, Dallas–Fort Worth, and New York topped the spending charts, with more than 150 million, 147 million, and 108 million dollars respectively. Dallas posted CPMs near 16 dollars, while Washington D.C. achieved around 7.85 dollars, signaling clear opportunities to optimize regional mix by balancing cost efficiency with strategic market value.

Across the board, leaders favored short video formats, often 15 seconds or less, built around value led messages. Promotions, bundles, and crave inducing visuals carried the first seconds of each spot, with static banners playing only a minor supporting role.

Download the Full U.S. Restaurants and Delivery Report

This blog highlights only a portion of the findings. The full report includes complete channel breakdowns, DMA level benchmarks, creative examples, and deeper analysis of each leading advertiser. Access the complete Restaurant & Delivery Advertising report.