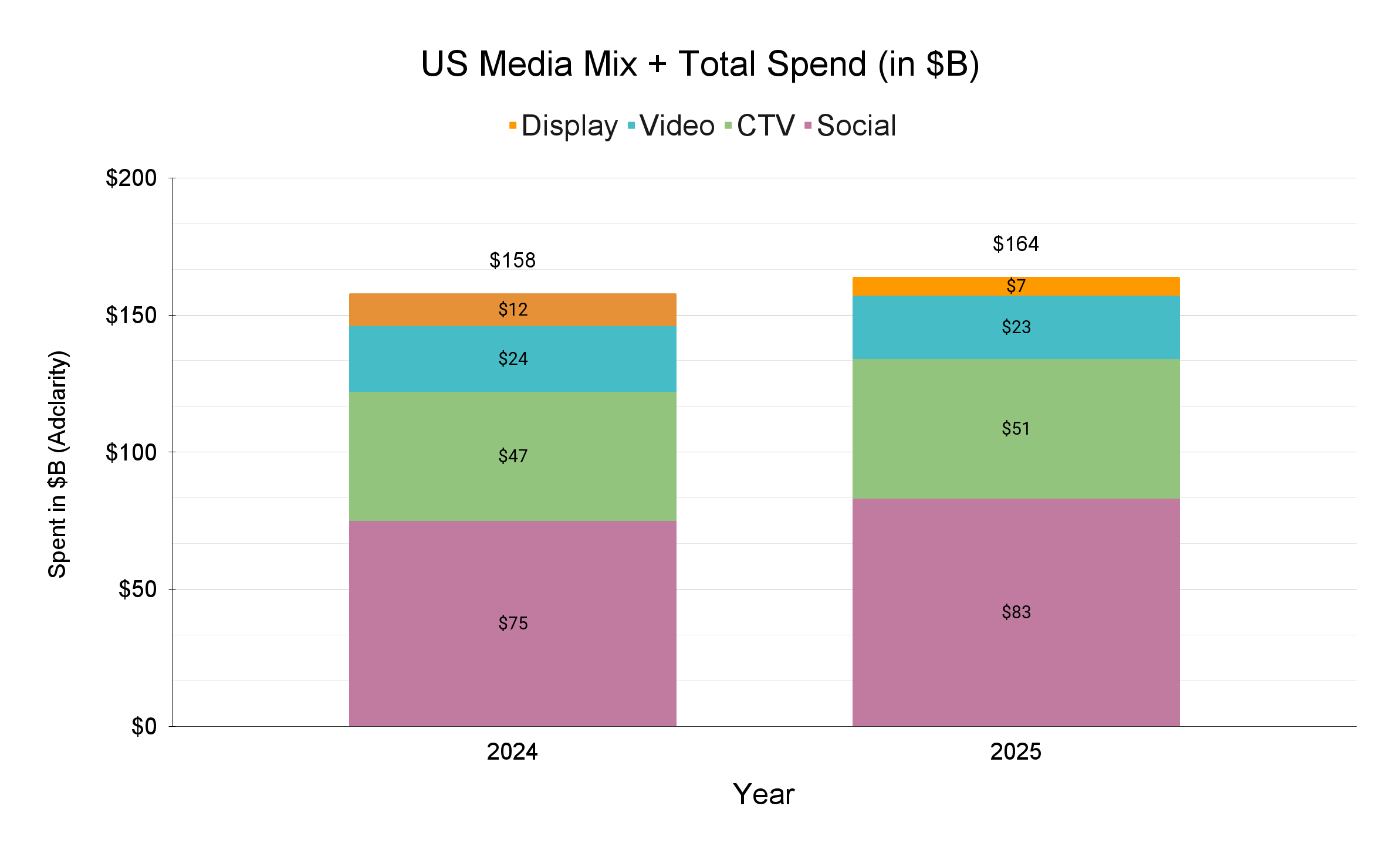

As we look back at 2025 from the start of 2026, our proprietary data shows a US digital ad market that grew modestly in total, but shifted sharply in how budgets were allocated. Across social, display, online video, and Connected TV, spend reached about 164.3 billion dollars in 2025, up roughly 4 percent from 157.9 billion dollars in 2024. The headline: social and CTV are doing the heavy lifting while display and video lose ground.

Social was the main growth engine. Investment rose from about 74.9 to 83.3 billion dollars, an increase of more than 11 percent year over year. That pushed social’s share of tracked digital spend from 47.4 percent in 2024 to 50.7 percent in 2025, meaning more than half of all dollars in these channels now flow into social environments. CTV also expanded, climbing from 46.9 to 51.3 billion dollars, up just over 9 percent, and nudging its share of spend from 29.7 to 31.2 percent. Together, social and CTV now account for more than four out of every five dollars in the digital mix.

Display Under Pressure, Video Softens

The flip side of this growth is visible in display and online video. Display spend fell sharply from roughly 11.7 to 6.9 billion dollars, a decline of more than 40 percent. Its share of total tracked digital spend dropped from 7.4 percent to 4.2 percent, signaling that most advertisers now see standard display as a secondary or support channel rather than a core pillar.

Online video also contracted, though much less dramatically. Budgets decreased from about 24.4 to 22.9 billion dollars, a 6 percent drop, and video’s share slipped from 15.4 percent to 13.9 percent. In practice, much of the storytelling and upper-funnel work that once sat in online video is being rebalanced toward premium CTV placements and high-engagement social formats.

Why Social and CTV Keep Gaining Share

The data suggests a structural shift rather than a one-off budget adjustment. Social continues to combine reach, performance, and creative flexibility, especially as retail media, creator content, and shoppable formats mature. CTV benefits from the steady migration of audiences into streaming environments and from better measurement that makes large-screen impressions more accountable and easier to benchmark against digital video and social.

It is also important to note what this dataset does not include. These figures focus on social, display, online video, and CTV and do not cover offline media or search marketing. According to the IAB Internet Advertising Revenue Report, produced annually with PwC, US search advertising alone generated roughly 103 billion dollars in 2024 and represented almost 40 percent of all digital ad revenue, so the broader digital market is probably at least a third larger than the subset shown here.

What Marketers Should Do in 2026

For marketers planning 2026 budgets, the takeaway is clear. Treat social as the backbone of digital reach and performance, with formats and audiences tuned to each stage of the funnel. Use CTV as the premium layer that builds brand preference and extends frequency in high-value households, especially around major commerce moments. Reserve display for cost-efficient coverage and retargeting, and deploy online video where it can bridge the gap between social scale and CTV impact.

The brands that win in 2026 will not just follow these shifts; they will measure them. AdClarity’s granular spend, share, CTR, and CPM data across social, video, display, and CTV makes it possible to see where market leaders and competitors are leaning in, where they are pulling back, and how to reallocate budgets toward the channels that now drive the most growth.

See AdClarity in action. Request a demo today.