Over the last five quarters, U.S. accommodation and hotel advertisers have quietly reshaped how and where they spend. From Q3 2024 to Q3 2025, digital budgets shifted heavily into Connected TV and social, impressions exploded past 200 billion, and a small group of brands set the tone for the category.

CTV Leads Spend, Social Owns Impressions

In Q4 2024, almost half of category digital spend went to social, with roughly a third to Connected TV, and the rest split between online video and display. Fast forward across the next four quarters and the balance changes again. CTV takes the lead at about 41 percent of spend, with social close behind at 37 percent.

On the impression side, social dominates. It delivers 115.5 billion impressions over the period, comfortably ahead of online video at 39.7 billion, CTV at 28.9 billion, and display at 27.9 billion. Social is clearly the engine of reach, while CTV and video act as high impact layers that lift awareness and justify higher CPMs.

Hotel Leaders Are Playing Very Different Games

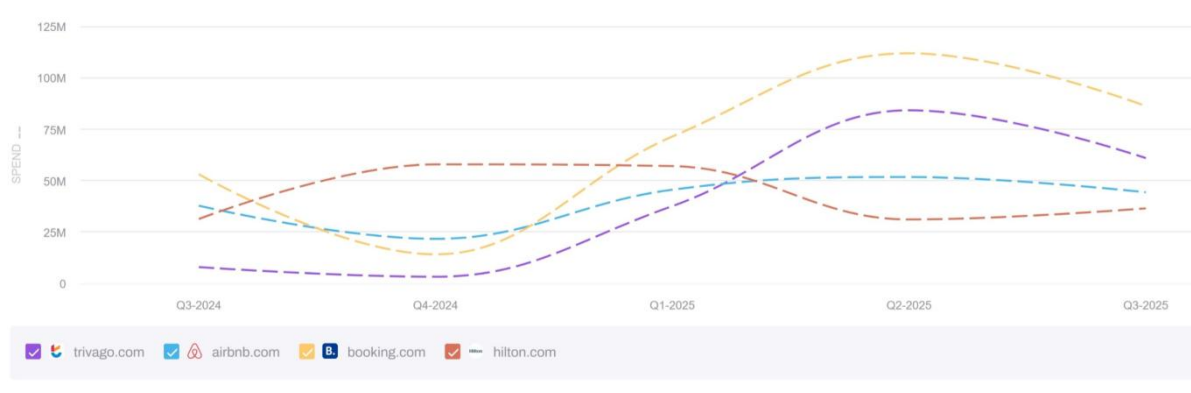

The report highlights four brands that consistently lead spending in the category: Booking.com, Hilton, Airbnb, and Trivago. Their media mixes could not be more different.

Trivago is almost all in on CTV, putting roughly 96 percent of its budget into big screen environments. Airbnb splits its investment between CTV at about 48 percent and social at around 38 percent, with targeted video to extend reach. Booking.com leans hardest into online video at close to 47 percent of spend and uses about 34 percent on CTV. Hilton keeps things more balanced, with around 40 percent of spend in CTV and 39 percent in social, supported by video.

Regional Shifts You Cannot Ignore

New York and Los Angeles still anchor the category, but their combined share has slipped from around 18 percent to about 14 percent as budgets spread into other markets. Dallas and Houston are gaining ground, while Miami softens and cities like Philadelphia and Boston tick upward. Trivago, in particular, over indexes in Houston and several secondary metros, signaling a deliberate tilt toward performance economics rather than prestige-only markets.

Get the Full U.S. Accommodation and Hotels Outlook

This article touches only the surface. The full report includes quarter by quarter spend, detailed channel splits, DMA level shifts, and a Q4 2025 outlook that projects roughly 400 million dollars in digital spend, up 22 percent year over year. Access the complete Accommodation and Hotels Digital Advertising report.