The U.S. restaurants and delivery category stayed intensely competitive in September 2025, with a small group of brands driving a disproportionate share of digital visibility. AdClarity’s latest snapshot shows how much they spent, where they showed up, and which tactics are winning the fight for hungry consumers’ attention.

Five Brands Setting the Pace

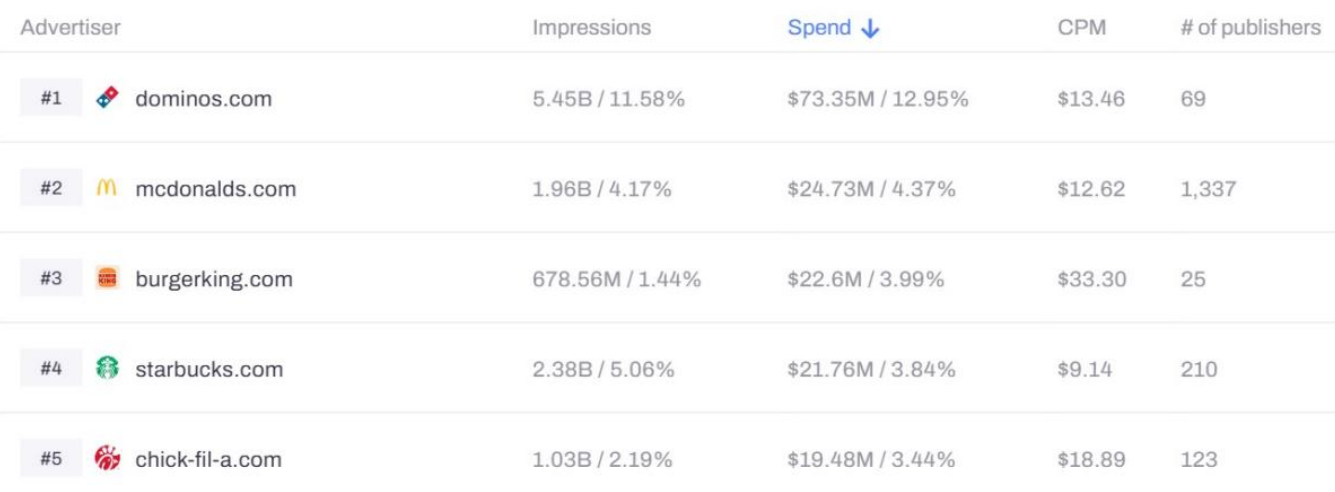

In September, Domino’s, McDonald’s, Burger King, Starbucks, and Chick-fil-A emerged as the top five digital advertisers in U.S. restaurants and delivery. Together, they accounted for a significant share of both impressions and spend across the category.

Domino’s led the pack with well over 5 billion impressions and an estimated 70 million dollars in digital investment for the month. McDonald’s and Burger King followed with high-impact video campaigns that prioritized quality placements over pure volume, while Starbucks and Chick-fil-A added strong lifestyle and family focused messaging to the mix.

Social Scale, CTV Impact

Channel data reveals an impression heavy, brand building category. Social drove about 28.4 billion impressions, roughly 60 percent of the total, while taking only around 35 percent of digital spend at a CPM of just under 7 dollars. That combination makes social the default engine for reach and frequency.

Connected TV told a different story. It absorbed close to half of total ad spend, nearly 50 percent, yet generated under 20 percent of impressions at CPMs north of 30 dollars. Advertisers clearly view CTV as a premium environment for storytelling, new product launches, and brand recall, not just another performance channel. Video, with mid range CPMs, bridged the gap between social scale and CTV impact.

What It Means for Competing Brands

The September data underlines two realities. First, the category is highly concentrated. A handful of major quick service and coffee brands are buying enough media to shape consumer expectations, from value offers to seasonal beverages. Second, simply matching spend is unrealistic for most challengers.

Instead, emerging and mid tier restaurant and delivery players will need sharper regional strategies, more precise audience segmentation, and bolder creative testing to stand out. That might mean leaning harder into cost efficient social in selected DMAs, pairing it with targeted CTV flights rather than always on national campaigns.

Get the Full Restaurants and Delivery Report

This blog only scratches the surface of the September numbers. The full report includes detailed rankings, channel level spend and impression data, CPM benchmarks, and examples of top performing creatives from each leading advertiser. Access the complete Restaurants & Delivery September 2025 report.