The U.S. grocery category is in a race for attention, and September’s digital ad data shows just how aggressively brands are competing. AdClarity’s latest view into the market reveals who is spending, where they are investing, and how strategy is evolving as shoppers split their time between aisles and apps.

Top 5 Advertisers Reshaping U.S. Groceries

In September, H-E-B led the pack among U.S. grocery advertisers, followed by Kraft, Kroger, Instacart, and Heinz. Together, these five players illustrate how both retailers and CPG brands are using digital to influence the full path to purchase, from weekly stock-up trips to last-minute delivery orders.

H-E-B’s leadership reflects sustained investment in broad visibility and digital engagement, while Kraft’s position shows how a heritage brand can stay top of mind by leaning into digital-first creative and formats. Instacart’s presence in the top five highlights the growing power of delivery platforms as media owners in their own right.

Social Dominates Impressions, But Not Spend

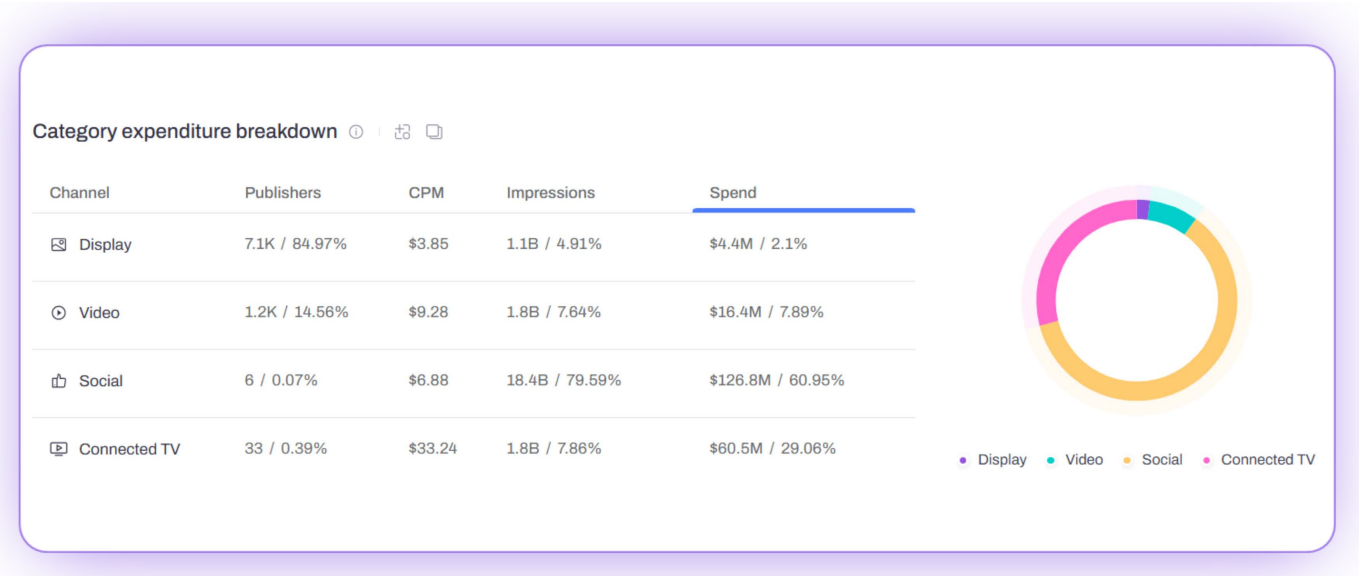

Social platforms generated 18.4 billion impressions in the grocery category during September, roughly 80 percent of total volume, yet they captured only around 61 percent of spend at an average CPM of about 6.9 dollars. That combination of scale and efficiency makes social the workhorse of grocery advertising, particularly for always-on campaigns and broad reach.

Display remains a supporting player: it accounted for just over 2 percent of spend and under 5 percent of impressions, even though ads ran across more than 7,000 publishers. For most brands, display now functions as a complementary layer rather than the core of the media plan.

CTV and Video Raise the Stakes on Brand

Connected TV captured close to 30 percent of digital ad spend while delivering under 10 percent of impressions, with CPMs north of 33 dollars. Advertisers are clearly willing to pay a premium for high-impact formats that build brand recall and reach households in a lean-back environment. Video sits between social and CTV on both pricing and role, adding storytelling and product demonstration to performance-oriented plans.

The bigger pattern is clear: in groceries, the largest advertisers still win on volume, but the most sophisticated teams win on targeting, creative testing, and channel orchestration.

Get the Full U.S. Grocery Advertisers Report

This blog only scratches the surface. The full report includes detailed rankings, channel-by-channel spend and impression data, CPM benchmarks, and examples of top-performing creatives from each leading advertiser.

Explore the complete findings and see how your brand compares by downloading the full U.S. Grocery Advertisers report.