Most organizations see only partial advertising signals. That leads to fragmented insight, slower decisions, and missed opportunities. The challenges typically fall into three buckets:

- Data: Limited visibility into campaigns, competitors, and markets. Teams see snapshots, not the full cross-channel picture.

- Efficiency: Fragmented research and manual benchmarking. The work gets repeated across teams, regions, and reporting cycles.

- Money: Difficulty proving ROI and ROAS. Without consistent context and benchmarks, performance stories become harder to defend.

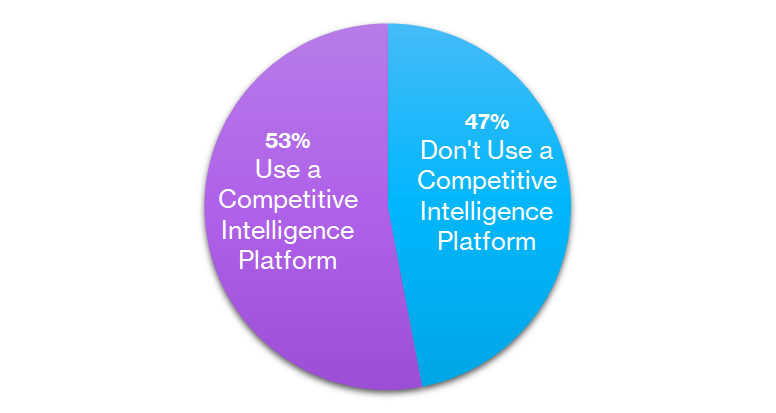

2026 research by Forrester points to an adoption split where 47% of organizations do not use a competitive intelligence platform and only 53% do. That divide explains why some teams are still walking in the dark with unreliable, manual workflows, while others spend time validating whether the data is trustworthy and whether coverage is truly cross-channel and cross-region.

The Benefits of a Strong Competitive Workflow

A more effective approach starts by replacing guesswork with a trusted source of competitive truth. When teams have a consistent view of what competitors are doing, decision making shifts from reactive to proactive.

From there, the priority becomes ongoing monitoring of competitor activity across channels and markets. The goal is not one-off checks, but a clear, repeatable way to understand where competitors are investing, how they are sequencing campaigns, and which markets they are testing or scaling.

Next comes benchmarking creatives and messaging. It is not enough to know that spend increased. Teams need to understand what creative formats are being pushed, what value propositions are showing up repeatedly, and which messages and placements are winning attention over time. This helps move analysis from “who spent more” to “what is working and why”.

With that foundation, it becomes easier to spot blind spots and whitespace. That includes channels where competitors are underinvested, markets they have not expanded into yet, and audience segments that are being overlooked. Those gaps often turn into the fastest opportunities, especially when identified early.

Finally, competitive intelligence is most valuable when it supports planning. Preparing for 2026 means understanding where investment is shifting across formats and channels, and separating short term experimentation from longer term trend signals. Teams that track these changes early can set budgets and creative priorities with confidence and success.

Interested in Competitive Visibility and Measurement?

In our upcoming webinar, “Reveal Competitor Ad Strategy In 2026: Spend, Creatives & Channel Moves”, we will break down why competitive insight stays fragmented across display, social, online video, and CTV, and what teams can do to fix it with a practical, repeatable approach. We will share a clear framework to assess gaps and build a more reliable cross-channel workflow, so make sure to reserve your spot here.